Maybank Investment Bank Berhad: Malaysia's Healthcare 2020 Outlook

In retrospect. Share prices of hospital players fell 7% YTD and was in line with

that of FBM KLCI (-8% YTD). Meanwhile, glove sector underperformed FBM KLCI

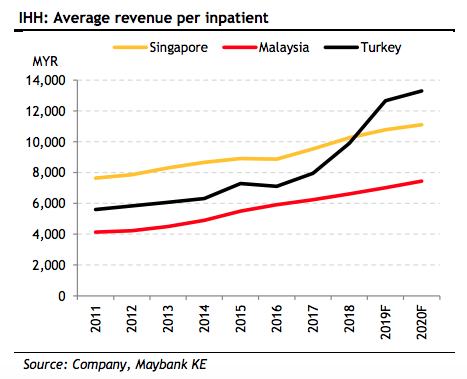

with its share price falling 13% YTD. Weakness in IHH’s share price was due to

weaker core net profit (9M19: -8% YoY) and the ongoing court case against its

31%-owned Indian operation Fortis. As for KPJ, its 9M19 core net profit was

marginally lower (-1% YoY) due to the MFRS 16 impact and the stock was sold

down given the uncertainty surrounding the imminent drug price controls.

Meanwhile, glove players reported dismaying core net profit (9M19: -14% YoY)

due to a slower global demand in 1H19. This was exacerbated by the industry’s

capacity growth and competition from players in other competing countries, such

as China and Thailand. Additionally, the US’ tariff on China’s gloves did not

benefit Malaysia’s players as China re-routed their glove supply to other markets,

such as Europe.

Outlook / Thematic. Two key events to watch for the hospital players are: (i) Fortis’ court hearing on 3 Feb 2020. A positive outcome whereby the court rules that Fortis did not violate its “status quo” court order, could see IHH’s share price re-rate; and (ii) Malaysia’s drug price controls could be announced in early2020, which may result in lower drug sales revenue for the hospitals. However, we expect the hospital players to raise other hospital charges to maintain their margins.

For the glove players, we expect competition to remain intense in 2020. Though global glove demand may continue to grow at 8% in 2020, there could be a temporary supply overhang in view of the aggressive planned capacity expansion by the industry players. We estimate combined capacity growth of 16% in 2020 for Malaysia’s Big 4 and Riverstone. Additionally, MKE’s FX team expects USD vs. MYR to weaken gradually to 4.08 by end-20 (from 4.17 now), which could lead to lower sales receipts and sales volume for the glove players. In our earnings models, we have assumed a USD vs. MYR rate of 4.10 over FY20-21E.

Sector top BUYs. We have a BUY on KPJ: (i) we project EPS growth of 5% in FY20E, underpinned by the rising demand for private healthcare; (ii) the stock is oversold with its fwd P/E at 21x (below its -1SD to 5-year mean), while its EV/EBITDA is the lowest among regional healthcare peers. We also have a BUY on Kossan: (i) we project EPS growth of 15% in FY20E on its capacity growth of 17% in FY20E and stable margin as we expect its higher productivity to offset the potential ASP pressure; and (ii) its 12M forward P/E of 21x (mean: 22x, +1SD to mean: 27x) is at a wide 22-42% discount to Top Glove/Hartalega.

Risks. Key risks for the hospitals include: (i) inability to raise other hospital charges to offset the potential lower drug revenue upon the implementation of drug price control; (ii) shortage of healthcare workers faced by the whole industry may result in higher staff cost for the hospital operators. Key risks for the glove sector include: (i) a sharp drop in USD/MYR, which would adversely impact earnings as glove ASPs are usually adjusted on a gradual basis; and (ii) undisciplined capacity expansion across the industry, which could lead to severe supply overhang of gloves and heated ASP competition.

Source: Malaysia 2020 Outlook & Lookouts - Strategy Research Report by Maybank Investment Bank Berhad. Dec 16, 2019 Publication.

Outlook / Thematic. Two key events to watch for the hospital players are: (i) Fortis’ court hearing on 3 Feb 2020. A positive outcome whereby the court rules that Fortis did not violate its “status quo” court order, could see IHH’s share price re-rate; and (ii) Malaysia’s drug price controls could be announced in early2020, which may result in lower drug sales revenue for the hospitals. However, we expect the hospital players to raise other hospital charges to maintain their margins.

For the glove players, we expect competition to remain intense in 2020. Though global glove demand may continue to grow at 8% in 2020, there could be a temporary supply overhang in view of the aggressive planned capacity expansion by the industry players. We estimate combined capacity growth of 16% in 2020 for Malaysia’s Big 4 and Riverstone. Additionally, MKE’s FX team expects USD vs. MYR to weaken gradually to 4.08 by end-20 (from 4.17 now), which could lead to lower sales receipts and sales volume for the glove players. In our earnings models, we have assumed a USD vs. MYR rate of 4.10 over FY20-21E.

Sector top BUYs. We have a BUY on KPJ: (i) we project EPS growth of 5% in FY20E, underpinned by the rising demand for private healthcare; (ii) the stock is oversold with its fwd P/E at 21x (below its -1SD to 5-year mean), while its EV/EBITDA is the lowest among regional healthcare peers. We also have a BUY on Kossan: (i) we project EPS growth of 15% in FY20E on its capacity growth of 17% in FY20E and stable margin as we expect its higher productivity to offset the potential ASP pressure; and (ii) its 12M forward P/E of 21x (mean: 22x, +1SD to mean: 27x) is at a wide 22-42% discount to Top Glove/Hartalega.

Risks. Key risks for the hospitals include: (i) inability to raise other hospital charges to offset the potential lower drug revenue upon the implementation of drug price control; (ii) shortage of healthcare workers faced by the whole industry may result in higher staff cost for the hospital operators. Key risks for the glove sector include: (i) a sharp drop in USD/MYR, which would adversely impact earnings as glove ASPs are usually adjusted on a gradual basis; and (ii) undisciplined capacity expansion across the industry, which could lead to severe supply overhang of gloves and heated ASP competition.

Source: Malaysia 2020 Outlook & Lookouts - Strategy Research Report by Maybank Investment Bank Berhad. Dec 16, 2019 Publication.

.png)

Comments