7 Best Standalone Medical Cards in Malaysia 2022

If you need a straightforward and affordable medical insurance, you may need a standalone medical card.

We often read and hear about the importance of having a health insurance coverage, backed by the fact that the cost of a medical treatment has been on the rise over the years.

Quoting Antony Lee, the Chairman of The General Association of Insurance Malaysia (PIAM), as saying: “Medical inflation has been on an upward trend with double-digit increases in recent years and is projected to reach 14% in 2019.”

What does this supposed to mean? It means that getting a fever diagnosis with medicines and medical certificate at a private clinic can easily cost you more than RM100 per visit.

Unless you are settled on relying heavily to the public healthcare system, having a health insurance coverage is a necessity nowadays.

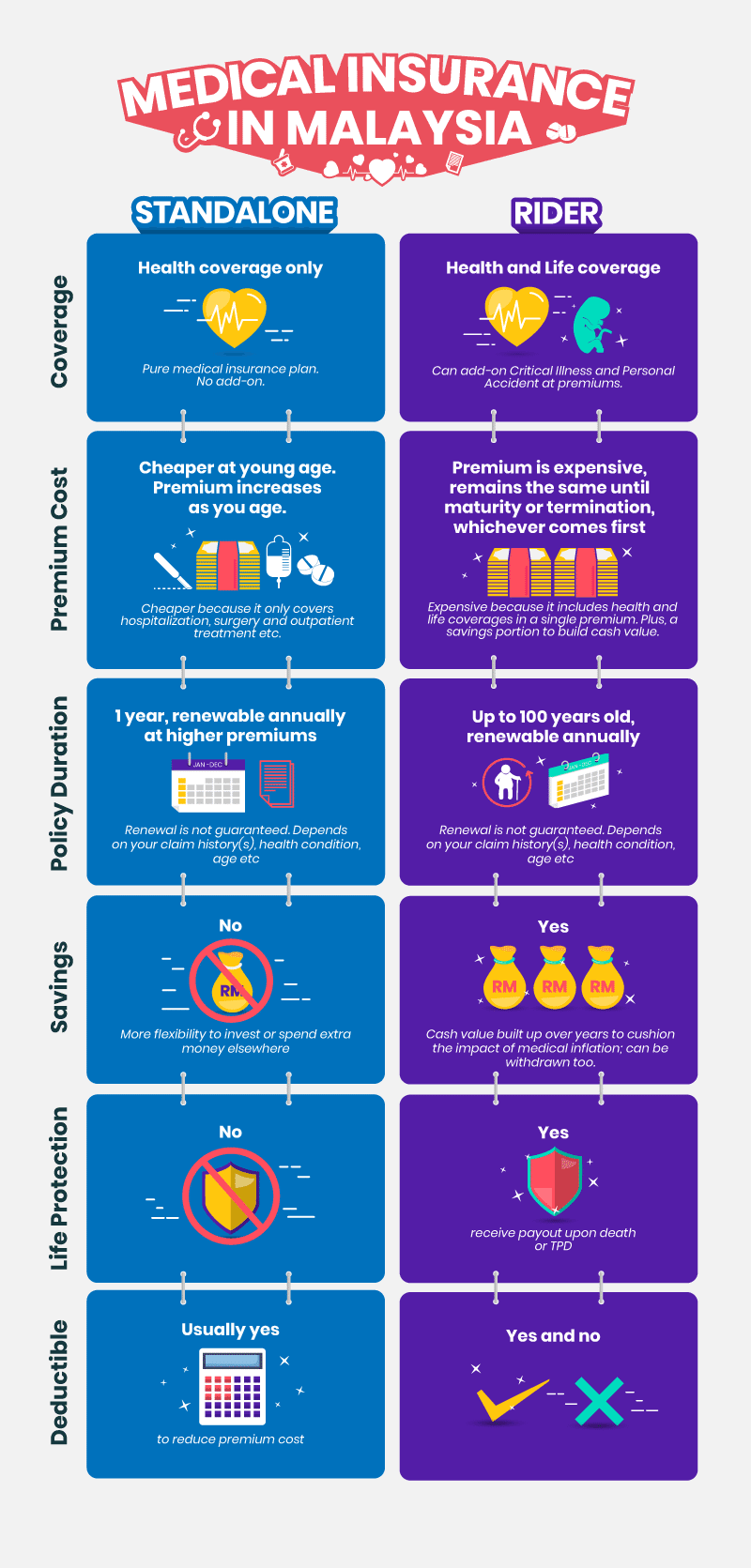

Medical insurance comes in 2 options: (1) standalone with no frills medical policy, (2) medical rider attached to a life insurance plan such as an investment-linked policy.

Standalone Medical Card versus Rider Medical Card

The most important highlight that differentiates a Standalone from Medical Rider is the premium cost; Standalone medical card is way cheaper compared to a rider for several reasons:

Choosing the right medical card for yourself and/or family members requires a strategic financial planning.

If your purpose is to get covered for health only and want to save money on premiums, a standalone medical card is the right way to go.

Standalone Medical Card is cheaper

Standalone medical card is a term insurance plan that provides coverage such as hospital, surgical, outpatient and other medical benefits.

The best part about this cash-over-cover insurance plan is it is much more affordable than a rider medical card because it is a pure medical insurance plan.

Here is the list:

A-Life Med Regular offers high annual limits (up to RM150,000 per insured item) and zero lifetime limits, up to age 100. It also covers post-hospitalisation treatment for up to 120 days, the longest coverage available in our comparison.

While Takaful Malaysia’s myClick MediCare doesn’t offer the cheapest plan in Malaysia, its premiums are on the lower end. It offers better-than-average coverage (no lifetime limit, up to RM100,000 annual limit) for plans in its price range. You can also opt for a deductible plan to enjoy lower premiums.

Quoting Antony Lee, the Chairman of The General Association of Insurance Malaysia (PIAM), as saying: “Medical inflation has been on an upward trend with double-digit increases in recent years and is projected to reach 14% in 2019.”

What does this supposed to mean? It means that getting a fever diagnosis with medicines and medical certificate at a private clinic can easily cost you more than RM100 per visit.

Unless you are settled on relying heavily to the public healthcare system, having a health insurance coverage is a necessity nowadays.

Medical insurance comes in 2 options: (1) standalone with no frills medical policy, (2) medical rider attached to a life insurance plan such as an investment-linked policy.

Standalone Medical Card versus Rider Medical Card

The most important highlight that differentiates a Standalone from Medical Rider is the premium cost; Standalone medical card is way cheaper compared to a rider for several reasons:

|

| Image via RinggitPlus.com |

Choosing the right medical card for yourself and/or family members requires a strategic financial planning.

If your purpose is to get covered for health only and want to save money on premiums, a standalone medical card is the right way to go.

Related: Best Medical Card in Malaysia

Standalone Medical Card is cheaper

Standalone medical card is a term insurance plan that provides coverage such as hospital, surgical, outpatient and other medical benefits.

The best part about this cash-over-cover insurance plan is it is much more affordable than a rider medical card because it is a pure medical insurance plan.

We take a look at the most popular medical cards in Malaysia and try to assist you in deciding which gives you the best value.

Here is the list:

AIA Medical Card Malaysia

AIA A-Life Med Regular Medical Card

Room & Board: up to RM250

Annual Limit: up to RM150k

Lifetime Limit: Not applicable

AIA A-Plus Health Medical Card

Room & Board: up to RM500

Annual Limit: up to RM2m

Lifetime Limit: No limit

AIA A-Plus Med Medical Card

AIA A-Plus Med Medical Card

Room & Board: up to RM500

Annual Limit: up to RM260k

Lifetime Limit: No limit

Takaful Medical Card Malaysia

Takaful myClick MediCare Medical CardRoom & Board: up to RM200

Annual Limit: up to RM100k

Lifetime Limit: Not applicable

Hong Leong Assurance MedGLOBAL IV Plus Medical Card

Annual Limit: up to RM240kLifetime Limit: up to RM1.2m

Room & Board: up to RM400

Coverage Age: From 1 months

No. of Panel Hospitals: 101

The HLA MedGlobal IV Plus plan covers emergency overseas treatments (subject to limitations and exclusions). It also comes with an annual limit of up to RM240,000, although it does not state its lifetime limit.

Allianz Medical Card Malaysia

Allianz MediAdvantage Medical CardRoom & Board: As Charged

Annual Limit: up to RM8m

Lifetime Limit: up to RM16m

Allianz Diabetic Essential Medical Card

Allianz Diabetic Essential Medical Card

Room & Board: up to RM400

Annual Limit: up to RM1.4m

Lifetime Limit: up to RM4.2m

Allianz Booster Care Medical Card

Allianz Booster Care Medical Card

Room & Board: As Charged

Annual Limit: up to RM200k

Lifetime Limit: RM1m

Allianz Care Individual Medical Card

Allianz Care Individual Medical Card

Room & Board: up to RM400

Annual Limit: up to RM125k

Lifetime Limit: Not applicable

Allianz MediSafe Infinite+ Medical Card

Allianz MediSafe Infinite+ Medical Card

Room & Board: up to RM500

Annual Limit: up to RM2.5m

Lifetime Limit: No limit

Prudential Medical Card Malaysia

Prudential PRUValue Med Medical Card

Room & Board: up to RM600

Annual Limit: Not applicable

Lifetime Limit: Not applicable

Prudential PRUMillion Med Medical Card

Prudential PRUMillion Med Medical Card

Room & Board: up to RM500

Annual Limit: up to RM2m

Lifetime Limit: Not applicable

Prudential PRUsenior med Medical Card

Prudential PRUsenior med Medical Card

Room & Board: from RM200

Annual Limit: Not applicable

Lifetime Limit: up to RM225k

Prudential PRUHealth Medical Card

Prudential PRUHealth Medical Card

Room & Board: up to RM600

Annual Limit: up to RM250k

Lifetime Limit: up to RM2.6m

AXA Medical Card Malaysia

AXA Affin eMedic Medical CardRoom & Board: up to RM250

Annual Limit: up to RM100k

Lifetime Limit: No limit

AXA Affin SmartCare Optimum Plus Medical Card

AXA Affin SmartCare Optimum Plus Medical Card

Room & Board: up to RM500

Annual Limit: up to RM2.1m

Lifetime Limit: Not applicable

AXA Affin SmartCare Optimum Medical Card

AXA Affin SmartCare Optimum Medical Card

Room & Board: up to RM500

Annual Limit: up to RM500k

Lifetime Limit: Not applicable

Great Eastern Medical Card Malaysia

Great Eastern Smart Medic Medical CardRoom & Board: up to RM400

Annual Limit: up to RM200k

Lifetime Limit: up to RM2m

Great Eastern Smart Extender Max Medical Card

Great Eastern Smart Extender Max Medical Card

Room & Board: up to RM400

Annual Limit: up to RM2m

Lifetime Limit: No limit

.png)

.png)

.png)

.jpg)

Comments